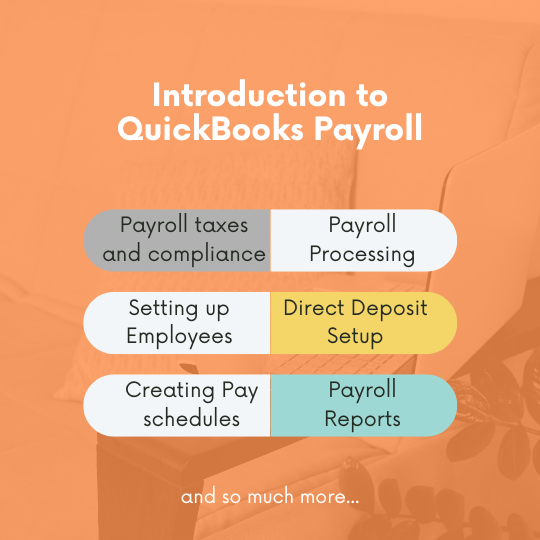

QuickBooks Payroll is a comprehensive tool designed to help businesses manage their payroll processes efficiently. It’s part of the QuickBooks suite, which is widely used for accounting and financial management. Here’s a brief course summary on QuickBooks Payroll:

Course Overview: This course is designed to provide a thorough understanding of QuickBooks Payroll, enabling participants to efficiently handle payroll tasks for small to medium-sized businesses. The course covers key features, setup procedures, and day-to-day operations within QuickBooks Payroll.

Course Modules:

- Introduction to QuickBooks Payroll:

- Overview of QuickBooks Payroll features and benefits.

- Different versions of QuickBooks Payroll (Basic, Enhanced, and Full Service).

- Setting Up Payroll:

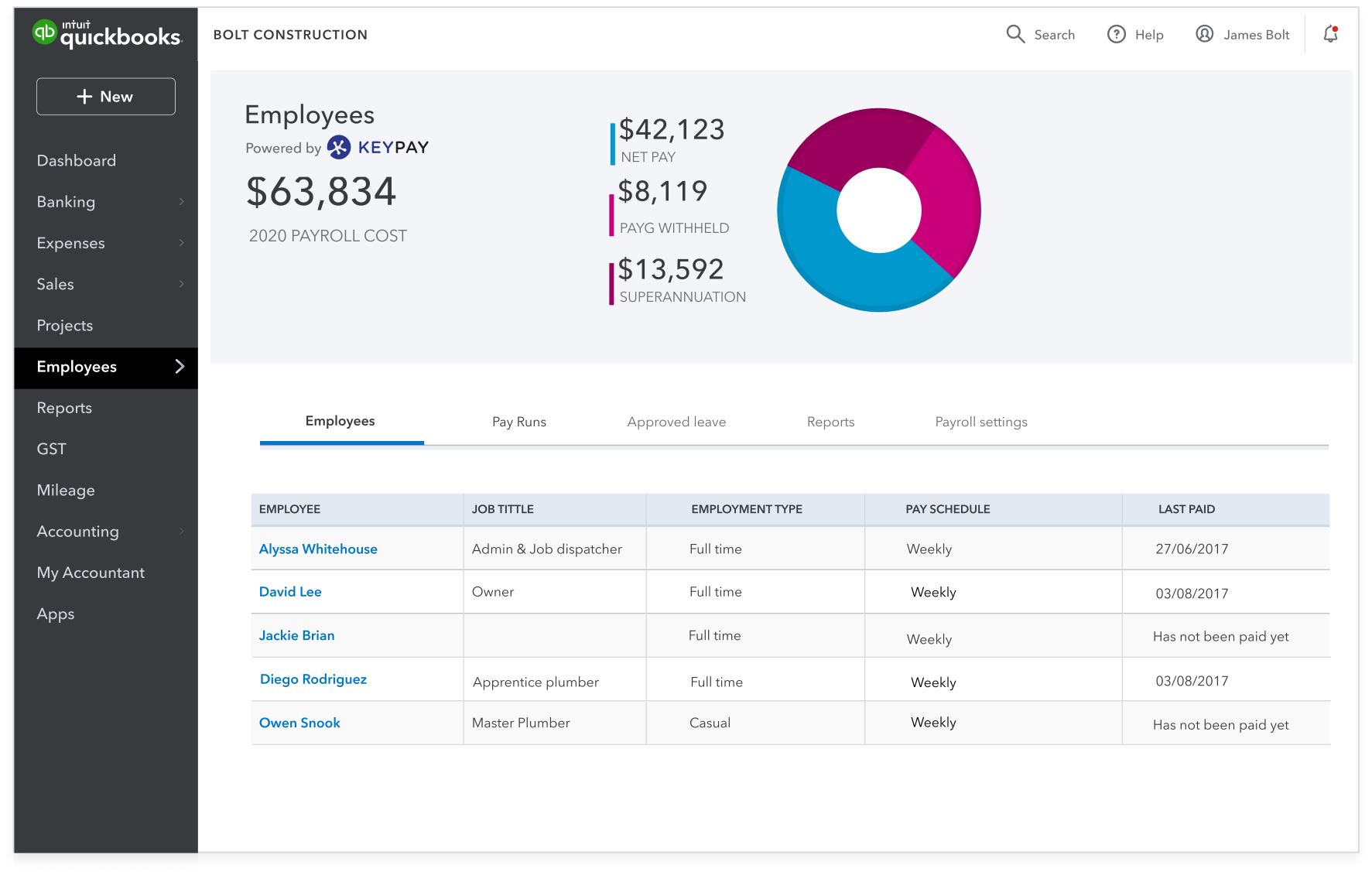

- Company and employee setup in QuickBooks.

- Tax setup and compliance.

- Processing Payroll:

- Creating paychecks and understanding different pay types.

- Handling deductions, benefits, and contributions.

- Tax Filing and Compliance:

- Understanding and managing payroll taxes.

- Generating and filing tax forms.

- Employee Benefits and Deductions:

- Managing employee benefits such as health insurance and retirement plans.

- Handling various deductions and reimbursements.

- Time Tracking Integration:

- Integrating time tracking tools with QuickBooks Payroll.

- Calculating and managing employee hours.

- Reports and Analytics:

- Generating payroll reports for analysis and compliance.

- Understanding financial implications of payroll through QuickBooks reports.

- Troubleshooting and Support:

- Common issues and how to troubleshoot them.

- Utilizing QuickBooks support resources.

Reviews

There are no reviews yet.