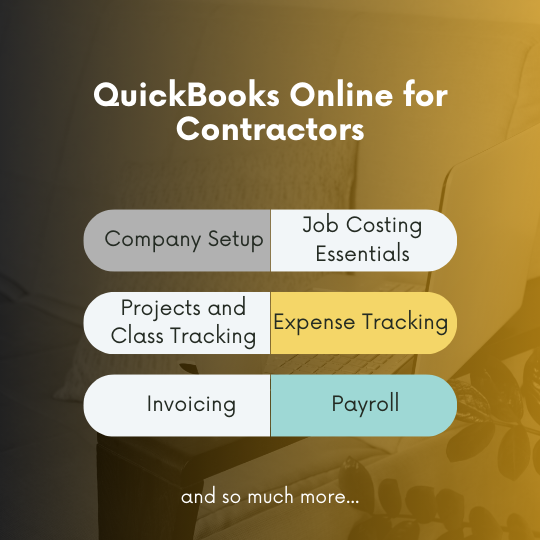

Course Overview: This course is designed specifically for contractors who wish to streamline their financial processes and get the most out of the QuickBooks software. From job costing to invoicing and payroll management, learn the ins and outs of QuickBooks tailored to the unique needs of the construction industry.

Target Audience:

- General Contractors

- Sub-contractors

- Construction business owners

- Construction accountants and bookkeepers

QuickBooks for Contractors: Course Summary

Course Overview: This course is designed specifically for contractors who wish to streamline their financial processes and get the most out of the QuickBooks software. From job costing to invoicing and payroll management, learn the ins and outs of QuickBooks tailored to the unique needs of the construction industry.

Target Audience:

- General Contractors

- Sub-contractors

- Construction business owners

- Construction accountants and bookkeepers

Course Modules and Objectives:

- Introduction to QuickBooks for Contractors

- Understand the importance of accurate financial tracking in the construction industry.

- Differentiate between various QuickBooks versions and their applicability to contracting businesses.

- Setting Up Your Company File

- Initiate and customize a company file tailored to your contracting business.

- Understand and implement the Chart of Accounts specific to the construction industry.

- Job Costing Essentials

- Define and differentiate between customers, jobs, and estimates.

- Learn how to allocate costs to specific jobs for precise profit analysis.

- Understand how to create and modify estimates.

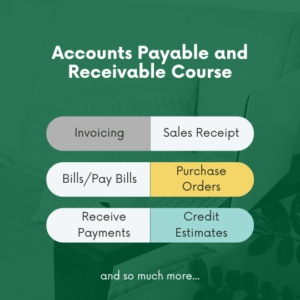

- Invoicing and Receiving Payments

- Generate progress invoicing and time & material invoices.

- Apply customer payments against specific job invoices.

- Manage retentions and track receivables efficiently.

- Expense Tracking and Vendor Management

- Record and allocate job-related purchases.

- Understand the nuances of subcontractor expenses and management.

- Set up and manage 1099s for subcontractors.

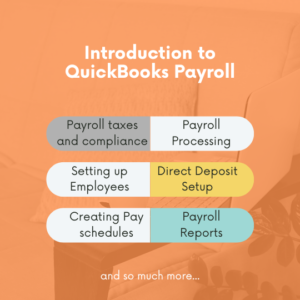

- Payroll in the Contracting World

- Customize payroll items for construction-specific needs.

- Allocate payroll expenses to jobs for accurate job costing.

- Manage workers’ compensation and related reports.

- Reporting and Financial Analysis

- Generate and interpret key financial reports specific to contracting, such as Job Profitability and Cost-to-Complete.

- Understand the significance of Work In Progress (WIP) reporting.

- Customize and save reports pertinent to your business operations.

- Tips, Tricks, and Advanced Features

- Learn shortcuts and efficiency tools within QuickBooks.

- Delve into advanced features like change orders and budgeting within the software.

- Understand the integration potentials with other industry-specific software.

- Ensuring Data Integrity & Security

- Regularly back up your company file and understand the restoration process.

- Implement security measures to protect sensitive financial data.

- Audit and troubleshoot common errors in the contractor accounting process.

- Future-Proofing & Scaling Your QuickBooks Use

- Integrate with other digital tools and apps specific to construction.

- Strategize for future growth using QuickBooks’ advanced features.

- Stay updated with new QuickBooks releases and industry-specific modifications.

Course Outcomes:

By the end of the course, participants should be able to:

- Set up and customize QuickBooks for their contracting business effectively.

- Implement accurate job costing, invoicing, and financial tracking procedures.

- Generate and interpret essential financial reports for strategic business decisions.

- Efficiently manage expenses, payroll, and subcontractor details.

- Safeguard their financial data and troubleshoot common issues.

Reviews

There are no reviews yet.