Course Description: Accounting Fundamentals is a comprehensive introductory course designed to provide students with a solid understanding of the core principles and practices of accounting. Whether you are pursuing a career in finance, business, or simply looking to enhance your financial literacy, this course is your essential foundation for financial success.

Course Objectives:

- Foundational Knowledge: Gain a thorough understanding of basic accounting concepts, terminology, and principles that underpin financial reporting and analysis.

- Financial Statements: Learn how to prepare and interpret key financial statements, including the balance sheet, income statement, and cash flow statement.

- Recording Transactions: Master the double-entry accounting system and understand how to record financial transactions accurately.

- Financial Analysis: Develop the skills to analyze financial data, assess a company’s financial health, and make informed decisions based on the results.

- Budgeting and Forecasting: Explore the fundamentals of budgeting and forecasting, enabling you to plan and manage financial resources effectively.

- Financial Ratios: Discover how to calculate and interpret various financial ratios to evaluate a company’s performance, liquidity, and solvency.

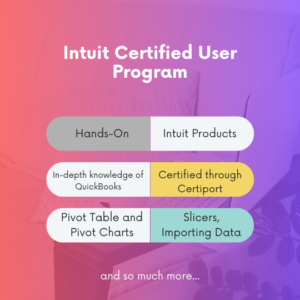

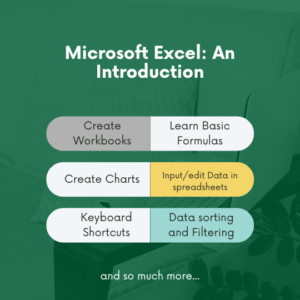

- Accounting Software: Gain hands-on experience with popular accounting software, such as QuickBooks or Excel, and learn how to use these tools for efficient record-keeping and financial analysis.

- Ethical Considerations: Explore the ethical responsibilities of accountants and the importance of maintaining the highest standards of integrity and professionalism in the field.

- Career Opportunities: Learn about the diverse career opportunities available to accounting professionals and the potential for growth and specialization within the field.

Course Format: This course combines theoretical knowledge with practical applications through a variety of teaching methods, including lectures, real-world case studies, group discussions, and hands-on exercises. Students will also have the opportunity to engage with accounting software to gain practical experience in recording financial transactions and preparing financial reports.

Who Should Enroll: This course is suitable for individuals with little to no prior accounting experience, as well as those looking to refresh their knowledge or explore accounting as a potential career path. It is highly relevant for business students, entrepreneurs, professionals in various industries, and anyone interested in personal finance.

Assessment and Grading: Assessment in this course will include quizzes, assignments, and a final project. These assessments are designed to evaluate your comprehension of the material and your ability to apply accounting principles to real-world scenarios.

By the end of Accounting Fundamentals, you will be equipped with a strong foundation in accounting, allowing you to make informed financial decisions, pursue further studies in accounting or related fields, and improve your career prospects in a variety of industries. Join us on a journey to financial literacy and excellence through the world of accounting.

Reviews

There are no reviews yet.